Investing can seem a daunting task, but it doesn't have to need to be. Robo-advisors are here to simplify the process, offering an effortless way to build your wealth. robotic investment management These automated platforms leverage technology to manage your investments based on your investment objectives.

- A key benefit of robo-advisors is their low fees.

- These platforms are easily available, requiring minimal funds to begin your portfolio.

- Additionally, robo-advisors provide ongoing asset management.

Whether you're a beginner investor or aiming for more sophisticated options, robo-advisors are a valuable tool to achieve your financial goals.

A Beginner's Guide to Robo-Advisors

Are you new to the world of investing? Feeling confused by all the possibilities? Robo-advisors could be your perfect solution. These automated systems make investing accessible even if you have no experience.

- Essentially

- Are software that

- oversee your investments for you. They use customized portfolios based on your investing style.

With a robo-advisor, you can start investing with just a few clicks and let the automation do the rest.

Begin your Robo-Investing Journey: A Step-by-Step Guide

Ready to automate your portfolio growth? Robo-advisors are making it simpler than ever. This practical guide will walk you through the process of getting started with robo-investing, from selecting the right platform to optimizing your holdings.

- Start with specifying your investment objectives. Are you planning for retirement, a major expense, or simply increasing your wealth?

- Explore different options and robo-advisors to find one that suits your needs. Think about factors like fees, investment strategies, and customer support.

- Once you've chosen a platform, register and submit your {financial information|. This will help the robo-advisor assess your risk tolerance and develop a personalized portfolio for you.

- Regularly monitor your investments and make adjustments as needed. Robo-advisors usually provide tools and resources to assist you in this process.

How to Pick the Right Robo-Advisor for You

Diving into the world of robo-advisors can feel overwhelming. With so many options available, it's crucial to locate the perfect fit for your financial goals and risk tolerance. To make this adventure a breeze, start by clarifying your investment aims. Do you want to save wealth for retirement, or are you interested in shorter-term outcomes? Next, consider your risk appetite. Are you comfortable with volatility, or do you prefer a more risk-averse approach? Once you have a clear understanding of your needs, you can start comparing different robo-advisors based on their charges, investment methods, and customer assistance. Refrain from being afraid to ask questions and do your research before making a decision.

- Remember that every robo-advisor is different, so take the time to investigate their offerings thoroughly.

- Read online reviews and gather feedback from other users to get a better perception of each platform.

- Finally, the best robo-advisor for you is the one that aligns your individual requirements.

Unlocking Passive Income: The Power of Robo-Advisors

In today's dynamic economic landscape, individuals are constantly seeking for innovative ways to maximize their wealth. Robo-advisors have emerged as a revolutionary force, presenting a powerful solution for attaining passive income streams with minimal effort. These automated platforms leverage sophisticated algorithms to design personalized investment portfolios tailored to your tolerance and financial goals. By removing the need for manual management, robo-advisors allow you to delegate your investments to experts while experiencing the advantages of consistent, hands-off growth.

Moreover, many robo-advisors offer a range of capabilities that can enhance your investment journey. These include portfolio rebalancing techniques, consistent performance reports, and availability to a team of financial advisors for personalized guidance. With their simple interfaces and cost-effective pricing models, robo-advisors have become an increasingly common choice for individuals of all knowledge bases who seek to grow a solid foundation for their financial future.

Mastering Robo-Investing: Tips and Strategies for Success

Embark on your automated investing journey with confidence by grasping these potent tips and strategies. First, diligently choose a robo-advisor that resonates with your investment goals and appetite for risk. Continuously monitor your portfolio's progress, making modifications as needed to achieve optimal outcomes. Remember, robo-investing is a marathon, not a sprint in the world of finance.

- Diversify

- Invest consistently

- Explore options carefully

By embracing these practices, you can maximize your chances of financial well-being.

Luke Perry Then & Now!

Luke Perry Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Kelly Le Brock Then & Now!

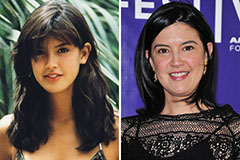

Kelly Le Brock Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!